The switch to Mondido

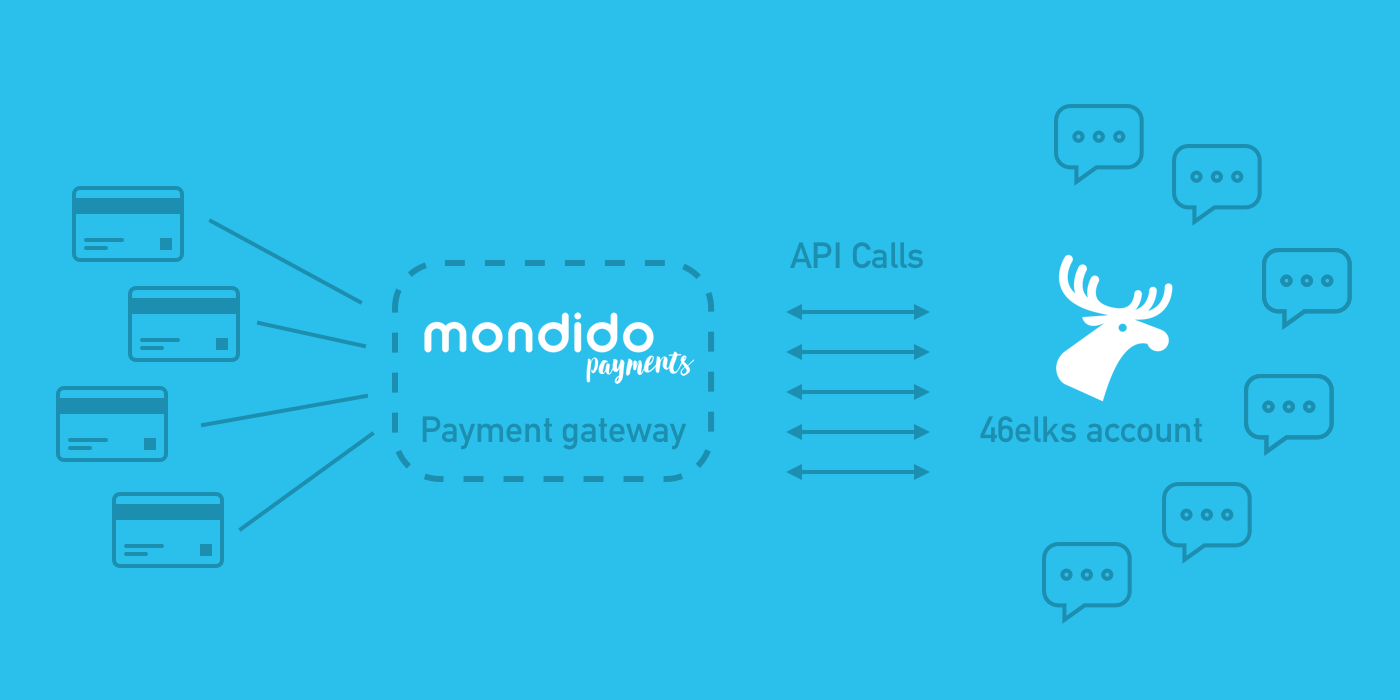

In 2016 46elks decided to implement Mondido as a fallback payment gateway.

The idéa was to use Mondido if there were issues with the primary payment gateway. This was why the integration was started. The reason we selected Mondido as fallback gateway was:

-

No fixed fees.

-

Seemed simple to implement.

-

We did know about them from the SUP46 community.

However after running our primary gateway for a while we did notice some horrible problems:

-

They were unable to prevent the majority of payments with stolen cards and we had to cover the cost of sent messages with stolen credits by refunding the payments.

-

The payment reports for the book-keeping where very hard to handle resulting in lots of work for the book-keeper.

-

The primary gateway needed a complex SDK to work in a simple way.

During an error with an update of the SDK, we did an emergency switch to Mondido. Since the switch we have been using Mondido, and we are very happy with that.

3DS

The 3D Secure ( Verified by Visa , MastercardⓇSecureCode™ , American Express SafekeyⓇ , and JCB J/Secure™ ) provides the safety we need, since the number of stolen cards is reduced close to zero, and even when there is a stolen card we do not have to cover the cost. For us stolen cards are extra problematic since the messages sent are often phishing SMS or spam. This could have caused the operators to block our connection to the telecom network in the long run.

Real contract

With the original gateway we did have one contract that included PSP and card acquirer in one, this was easy to get but left us with very little control. The acquirer we have with Mondido does allow us to negotiate the contract for example the number of days we have to wait for the money. And the acquirer ( Teller ) is huge and even if we had to wait for the payment for twenty days, (in reality we wait for as short as two days) the economic risk is close to zero. Teller also gives simple reports for book keeping. This saves us at least 4 hours of bookkeeping monthly.

Best entry level price

When we decided to check the price details for Mondido we noticed that the price was extremely appealing. Even better than our primary gateway. Mindido does give different price levels for expensive cards like AMEX (1,9%-3%) and low cost for cards like Visa/Mastercard ( 1,89% ), instead of giving a high start cost percentage for all cards.

Great API

When implementing the API some other great benefits were found:

Secure

The payment system adds extra safety for us because:

-

Only our Backend can initiate a payment process by issuing a payment order-ID. This way even payments failing anywhere in the process can be tracked and completed. This way we can follow failed attempts thus identify and block fraudulent accounts.

-

We never store the card details not even a token. The data is sent directly from the page to the Mondido backend. Even for the stored cards we can just query Mondido for the token when needed, all we need to do is keep a secure API password.

-

SSL with Extended Validation is used by Mondido, this can be used by payment window to ensure the user that the card details are handled by Mondido, if needed. Or you may even have a sales page with http (I do not recommend it but you could) or have a page with Let’s Encrypt for the page and hosted window for the payments.

Simple

It was simple to implement the API, there were SDK s available but using our own framework was equally simple. The API is closely integrated with our system and therefore it is a low amount for code and in turn less bugs. The endpoints are easy to understand. However one thing that was hard to understand was how to use the the filter functionality when querying data from the API.

Costumer with reference

We do supply our user id to the payment, this makes it easy to follow payments for a single user as well as a simple way to verify payments. When we created the integration we did think that this was a problem because adding the customer ID required 10-20 lines of extra code. But we are very happy that we did implement it because the benefits are worth it! It is possible to skip this by simply using the same ID all the time, but don´t, you would probably regret it.

One line code for storage of card

When we wanted to add recurring payments we spent quite a few hours planning how to implement it with the old payment gateway, and it became so cumbersome that we never really completed this task. With Mondido it was just one line of code:

<input class="storecard" type="checkbox" name="store_card" value="true">Store my card for future payments.

Resulting in this in the 46elks Dashboard:

The card is stored on the user ID and can be accessed and used in the API.

JS or Hosted page

One benefit we have not completely taken an advantage of is that there is a JS and a hosted page option for payment, this means that we could offer SMS payment for example by simply sending a link to a hosted payment in Mondido. We are only using the JS version this is great for giving the user the on page experience. But what is great with the in hosted page is that you can change everything on it. We have not used these options to a huge extent, but I'm sure there is lots of innovation to be done with these options.

More EU options available

Mondido is based in EU (Sweden) and understands that not all is about Credit Cards, so they also offer invoice payment, etc. They also support local payment methods like Swish. This is very interesting for us since it lowers the barrier to get started with our platform.

International support

The payments from countries around the world work great as well. We were not sure that this would be the case. But our worries were proven wrong and international credit cards have been working very well.

They do not market well for developers

For us the major benefits of using Mondido do not really match their primary marketing slogans, which are:

-

We help you convert more visitors into paying customers.

-

Increase Sales and lower your costs with Mondido.

-

Mondido offers card fees of 1,89 SEK + 1.89% per payment.

-

A/B testing support.

These are not very interesting things for a developer. I do think the major benefits with Mondido from our experience have been these:

-

Mondido allows you to adapt your user experience in every detail.

-

Mondido is simple to implement, keeping the integration cost low.

-

Mondido does not have a “one size fits all” contract but a base one that is adapted to the customer needs along the way.

Written 2017-02-15 by Martin Harari Thuresson